Blog

Stretching a Dollar in Retirement

- Posted on Feb 8, 2024

Here’s What It’s Like to Retire on Almost Nothing but Social Security

Four retirees with limited incomes open up about how they make it work

By Veronica Dagher

Many Americans reach retirement with almost no savings. No 401(k). Few investments. And almost no income aside from a monthly Social Security check.

Roughly one in seven Social Security recipients ages 65 and older depend on their benefits for nearly all their income, according to an AARP analysis. Unable to maintain the lifestyle of their working years, they trim their already trim budgets, move into smaller homes, or rely on the kindness of relatives to get by.

Social Security was never intended to fully support retirees, said Anqi Chen, assistantdirector of savings research at Boston College’s Center for Retirement Research.

In 1940, when the program was new, Social Security replaced just over 20% of a typicalworker’s income at age 65. As Congress enhanced benefits, the figure rose to about 50% in theearly 1980s. It stands at under 40% today, according to Chen.

The average monthly Social Security check is about $1,900. That doesn’t go as far as it once did, said Sandy Markwood, CEO of USAging, adding that inflation and rising rents have led more older adults to seek help from her nonprofit’s Eldercare Locator tool and other organizations that provide support to seniors.

We spoke in depth with four retirees who rely mostly on Social Security benefits about their fears, joys and financial challenges. Though they don’t live as comfortably as those fortunate enough to have amassed $2 million or $5 million nest eggs, they say they have found ways to build fulfilling lives in retirement.

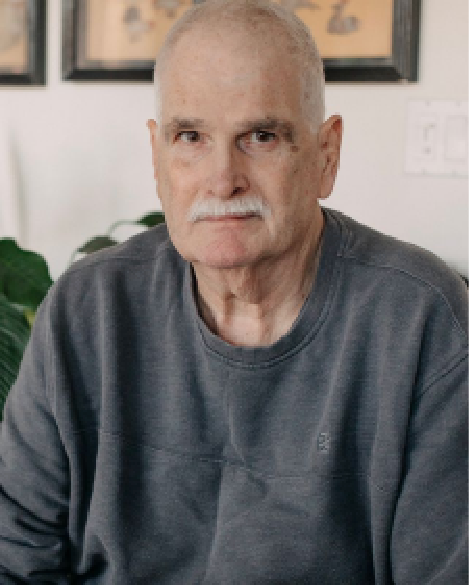

70 YEARS OLD

Eric Miller

Fredericksburg, Va.

MONTHLY SOCIAL SECURITY CHECK

$1,400

PHOTO: ABIGAIL GREY FOR THE WALL STREET JOURNAL

Eric Miller never wanted to leave the kitchen. The professional chef thrived on the intensity of restaurant life, often working 12-hour days six to seven days a week. A heart condition landed him in the hospital about seven years ago. After that, he had no choice but to hang up his knives.

Now 70, Miller said he was unprepared for sudden retirement, financially or otherwise, in part because he never planned to stop working, he said. At the height of his career he earned about $2,000 a week; now, his monthly Social Security check brings in about $1,400. He rents the basement of his sister’s home for about $500 a month including electricity. His other main expenses include food, gas and insurance. His six heart medications are largely covered by social services.

About 17 years ago, he moved to Arizona to care for his aging mother as her dementia and Alzheimer’s worsened. When she had a stroke, he took a nearly two-year career break to help care for her full-time until she died. He eventually moved back to Virginia, where he worked for a few more years. Though money is tighter than he would like, Miller is proudly debt free. He paid off more than $12,000 in credit-card debt this summer with the help of nonprofit financial counseling agency GreenPath Financial Wellness. He also got relief from his roughly $100,000 in medical bills for his four heart procedures, thanks to the hospital’s charity.

“I feel a lot less stressed,” he said. Miller, a retired professional chef, enjoys cooking for family and friends and watching his favorite football team, the Kansas City Chiefs, on television.

In retirement, he embraced budgeting for the first time, regularly tracking his spending in a spreadsheet. “I work on my budget religiously,” he said. Some months, he has about $150 left over, which usually buys him more food that he particularly likes such as chicken and vegetables.

The former high-school athlete enjoys watching football and basketball on television. His dog died last year, but he is considering getting a new one. “I’ll probably go to a pound,” he said.

73 YEARS OLD

Kathy Rote

Tucson, Ariz.

MONTHLY SOCIAL SECURITY CHECK

$1,040

PHOTO: CASSIDY ARAIZA FOR THE WALL STREET JOURNAL

Kathy Rote has been an advocate for people with disabilities her entire adult life. The retired social worker still helps friends with age-related mobility problems find the services they need to remain independent.

“Seniors are generally embarrassed by disability,” said Rote, 73. “It takes confidence to say, ‘I have this disability and it’s within my rights to seek accommodations.’” Afflicted with polio as an infant, Rote knows the challenges and expenses of life with a disability. Today she lives on her $1,040 Social Security check.

As a child, she used leg braces and Canadian canes to get around, and recounts being bullied in school. The obstacles she encountered inspired her to work for years for a nonprofit in Berkeley, Calif. Founded and run by people with disabilities, the organization focused on helping disabled people, including seniors, live and work independently.

Shortly after the Americans With Disabilities Act was signed into law in 1990, Rote started having chronic muscle pain and fatigue and was diagnosed with post-polio syndrome. She adjusted by using a motorized wheelchair. But by 1993, she lacked the stamina to work full-time and claimed Social Security Disability Insurance. Around age 66, those benefits stopped and she began getting retirement benefits. She moved to Tucson, Ariz., where she had attended college.

A folk singer and guitarist, she rejoined a group that had started the Tucson Folk Festival years before. An advocate for people with disabilities, Rote worked for years for a nonprofit on issues including accessible housing. She bought a home with the $60,000 her uncle left her, and has no debt. (She shares the home with Archie, her 90-pound rescue dog.)

Due to her age and income, Rote receives discounts on her property taxes, utilities and wireless bills. She saves about $150 a month for the taxes and pays about $135 for gas, electric and phone service. She supplements the $200 she spends on food each month with a $157 benefit her Medicare Advantage plan provides, which she uses to pay for over-the-counter medication and groceries.

Hiring attendants to help with housecleaning, wheelchair maintenance and food prep costs Rote $300 a month. She said the Pima Council on Aging reimburses her under a program intended to keep older adults in their homes. She enjoys getting to know her neighbors. She recently used her wheelchair-accessible van to help one move.

Rote said the recent deaths of her mother and five friends have convinced her “to make the effort to see people,” so she hosts occasional parties on her patio. “We sing songs and eat some food and talk about what really matters to each of us,” she said.

77 YEARS OLD

Joyce McKiney

Philadelphia

MONTHLY SOCIAL SECURITY CHECK

$1,800

PHOTO: HANNAH YOON FOR THE WALL STREET JOURNAL

Joyce McKiney, 77, wishes she’d spent more time learning about money when she was younger.

She didn’t know then how much boosting her earnings during her working years could have raised her Social Security benefits. She regrets not pushing herself to pursue higher education. She also wishes she had learned to pay her family’s bills so she didn’t have to get a crash course after her husband died in 2015.

McKiney worked in retail for years and then as a healthcare customer-service representative. She retired around 2001—sooner than she had hoped due to a medical issue. In a good year, she earned about $25,000. Her husband’s trucking job balanced their budget, she said. After he died, Joyce sold their home and moved into low-income senior housing. She gave up her car and landline. She learned how to budget and live within her new means. None of this was the plan. “You never know what the future is going to bring,” she said.

The couple had just refinanced the house and used the money to make necessary repairs and update its security system. She netted a roughly $4,000 profit from the sale—far less than the tens of thousands she had expected.

“It was an extremely difficult time,” she said. She felt lonely and anxious about money. She was close with her children, grandchildren and great-grandchildren but life just wasn’t the same.

McKiney enjoys the meals and activities the senior center offers including parties, games and field trips.

Now, she feels a bit more secure, though far from flush, she said. She has found ways to stretch her $1,800 Social Security check. Since downsizing, she pays about $343 a month for a storage unit. Her rent rose recently, to$584 a month. She spends about $68 a month for basic cable and $77 for her cellphone. An insurance policy costs about $269 a month. About $150 to $200 each month goes to food and about $100 for laundry. She takes subsidized senior transportation for a dollar a ride to get to most places.

McKiney is active in the social scene at the senior center where she spends most of her week days, arriving at the Allegheny branch of the Philadelphia Senior Center at around 9 a.m. and catching up with friends over free coffee and a $1 corn muffin. A game of pinochle might follow. Later for about a $1 donation she might have a hot lunch of ribs, green beans, mac and cheese and fruit cocktail. “They make better food than I’d make for just myself,” she said.

Knee problems keep her out of the center’s line-dancing classes, but she enjoys listening towhatever music is playing or taking the occasional field trip with friends. “Many of the people here are now like an extended family to me,” she said.

63 YEARS OLD

Barbara Talisman

Nomad

MONTHLY SOCIAL SECURITY CHECK

$1,970

PHOTO: LIN-CHEN KUEI

Barbara Talisman’s nomadic lifestyle satisfies both her wanderlust and retirement budget.

With limited savings, the former fundraiser for nonprofits had planned to work until at least age 65. But two years ago, with her 62nd birthday approaching, Talisman chose to call it quits, sell her belongings (except for her Tesla) and claim Social Security. “Life is short,” said Talisman, 63. “I was done. I wasn’t going to wait another three years.”

During her 18-year marriage she and her former husband spent much of their disposable income on travel, rather than saving for retirement. The couple attended the World’s Fair in Nagoya, Japan, in 2005 and saw the Iditarod Trail Sled Dog Race in Alaska in 2006. To escape Chicago winters, they traveled to Australia and Mexico and spent long weekends in Paris.

Toward the end of her career she began putting money into savings. Today, she has $151,000 in a retirement account and another $22,000 in a brokerage account. Although she mainly relies on her $1,970 Social Security check, she supplements it with investment account withdrawals of about $800 a month. She said it is enough to fund her globe-trotting. She booked four weeklong back-to-back cruises to Mexico in the fall of 2021, when prices were low due to lingering Covid concerns.

She settled briefly in Puerto Vallarta, but returned to Chicago when the weather got hot in Mexico. That winter, she followed the sun and did a stint in Melbourne, Australia, where she had worked from 2016 to 2018. Talisman, who lives a nomadic lifestyle, recently splurged on a trip to South America.

In Australia, she saved money by house sitting, one of her favorite hacks to cut costs.

Her food averages $300 a month and car insurance costs $134. Recently, she spent sevenmonths in California, spending about $500 a month on hotels between housesitting gigs. Talisman’s biggest expense is a $706 monthly loan payment for the Tesla she purchased in 2019, which will be paid off in a year. When overseas, she rents the car on Turo, income that generally covers her loan payment and insurance.

She is also launching a travel agency for solo women travelers and plans to keep wandering.

During Talisman’s five-month trip to Australia last winter, she spent about $10,000, including airfare.

This year, she is splurging. Since Dec. 1, she has been on a 50-day cruise in South America, with visits to Antarctica, the Galápagos and Machu Picchu. She will pull about half the balance in her $22,000 brokerage account. “This is going to blow the Social Security budget, but I only live once,” she said.